CPS 230

Achieve CPS 230 compliance with Codekeeper

Meet APRA's July 2025 deadline and protect your operations from software disruption with our state-of-the-art escrow solutions for financial institutions.

When your systems fail under CPS 230, the clock starts ticking. Your organization faces immediate reporting obligations, regulatory scrutiny, and potential penalties.

APRA's CPS 230: What you need to know

What is CPS 230?

CPS 230 is the new APRA standard for operational risk management taking effect July 2025. It introduces stricter requirements for managing disruptions, business continuity, and third-party relationships across the financial sector.

Who needs to comply with CPS 230?

CPS 230 affects all APRA-regulated entities, including:

Banks and ADIs

Insurance companies

Superannuation trustees

Financial groups

CPS 230 key requirements

APRA's CPS 230 requires financial institutions to implement these six key controls to ensure operational resilience:

1

Identify and control operational risks across all business functions.

2

Document critical operations with specific disruption tolerance levels.

3

Test business continuity under severe yet plausible scenarios.

4

Notify APRA of material incidents within 72 hours.

5

Maintain oversight of material service providers through formal agreements.

6

Create contingency plans for when service providers fail.

The software escrow — CPS 230 connection

Software escrow creates a direct pathway to CPS 230 compliance by securing your critical software assets when vendor relationships fail.

CPS 230 risk

Third-party service providers

Loss of access to critical software

Potential business disruption

APRA non-compliance

Software escrow solution

Secure source code repository

Legal framework for access

Verified recovery capabilities

Automated deposit management

Compliance outcome

Continuous operational resilience

Documented risk management

Evidence for APRA audits

Business continuity assurance

When APRA asks how you'll keep operations running if software vendors disappear, escrow gives you a ready answer. Without it, financial institutions lack access to source code, deployment instructions, and recovery procedures.

Let us help you with CPS 230 compliancy

Codekeeper brings together expertise in regulatory requirements and software protection with tailored solutions for APRA-regulated entities.

We see the challenges you face:

New operational risk standards with complex requirements

Regulatory deadlines with significant consequences

Uncertainty about documentation requirements

Continuous dependency on third-party software vendors

We've secured critical software assets for thousands of financial institutions globally. We can protect your operational resilience, too.

Codekeeper's complete solutions for CPS 230 requirements

Our escrow solutions directly satisfy CPS 230's operational resilience requirements while protecting your most critical software investments.

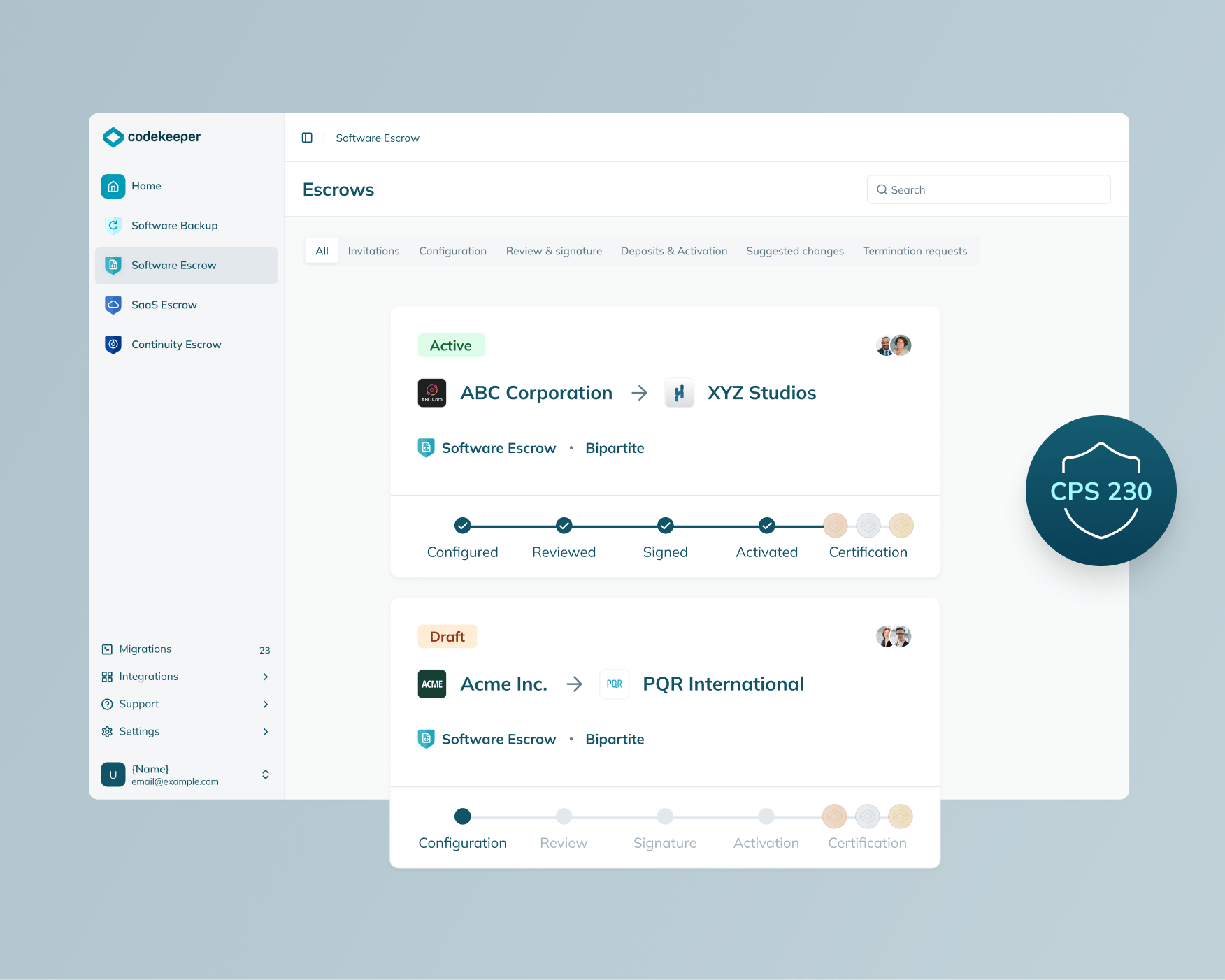

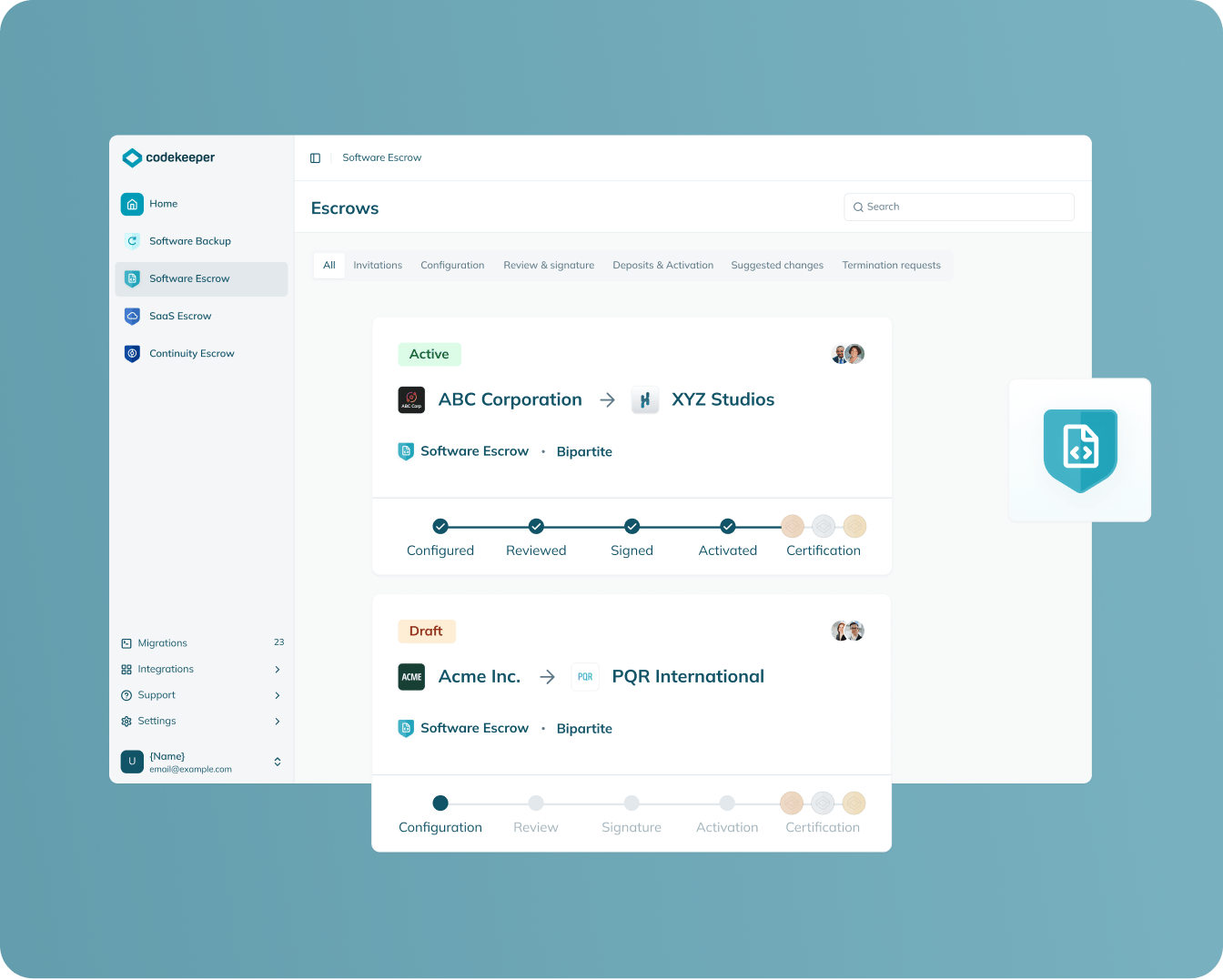

software escrow

Protection scope: On-premises software

Secures traditional on-premises systems with a legal framework that ensures continuous access to critical software assets.

Documents your control over third-party (and fourth-party) software risk

Establishes verifiable recovery capabilities for critical operations

Creates clear tolerance levels for software disruptions

Provides board-ready evidence of operational resilience

Learn more

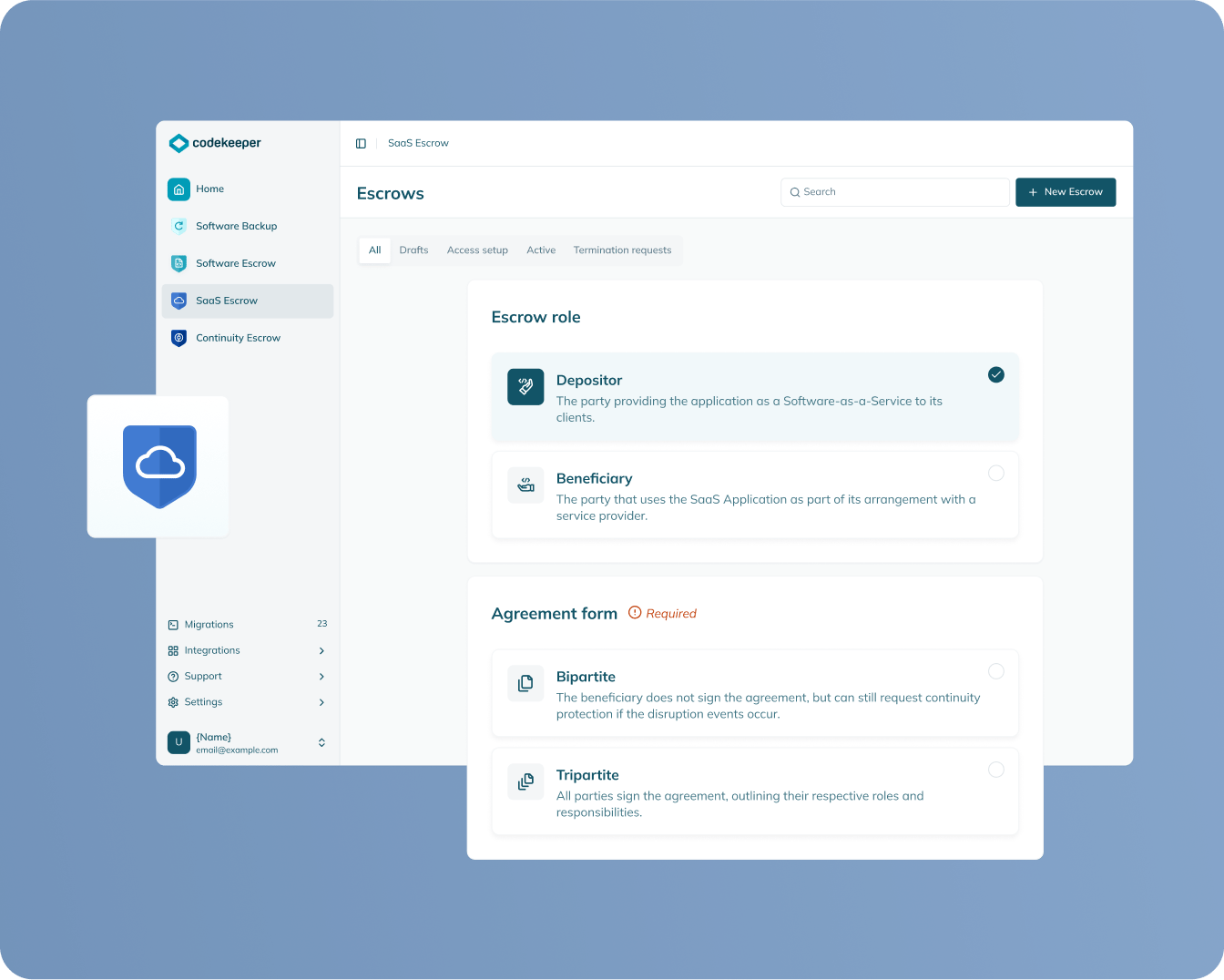

SAAS escrow

Protection scope: SaaS applications

Protects cloud-based applications with comprehensive deposits that include everything needed to maintain operations if SaaS providers fail.

Extends third-party risk management to cloud services

Guarantees business continuity for web-based critical operations

Addresses the growing migration to SaaS applications

Delivers documented compliance for modern technology stacks

Learn more

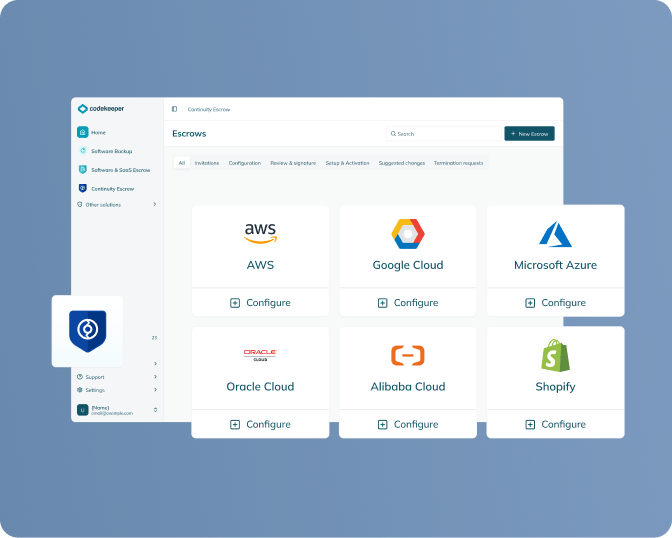

continuity escrow

Protection scope: SaaS applications

Takes over payments for supporting services and infrastructure to maintain critical operations when vendor relationships are disrupted.

Manages fourth-party risks from your vendor’s vendors as required by CPS 230

Reduces the likelihood of triggering 72-hour APRA notification

Creates operational continuity documentation for auditors

Supports board oversight of operational resilience

Learn more

verification

Protection scope: Software and SaaS applications

Tests escrowed assets to confirm they're complete and usable, with clear documentation that satisfies regulatory expectations.

Validates recovery capabilities with evidence

Establishes realistic recovery timeframes for tolerance levels

Generates testing documentation required by CPS 230

Offers Software Resilience Certificates for compliance records

Learn more

Get CPS 230 compliant in 4 simple steps

CPS 230 requires you to maintain access to critical software if vendors fail. Here's how to fulfill this requirement quickly:

1. Book your CPS 230 assessment call

Let us identify which of your software applications fall under APRA's material service provider requirements.

2. Choose your software protection level

Select basic escrow or add verification for complete CPS 230 evidence of operational resilience.

3. We'll handle everything else — from setup to implementation

Our team manages vendor onboarding, legal agreements, and deposit automation — no effort required from your team.

4. Get your Software Resilience Certificate

Receive formal documentation showing APRA that your critical software assets are protected against vendor disruption.

One call. One solution. Complete software continuity compliance for CPS 230.

Book a free demo

Codekeeper takes the complexity out of compliance

Over the years, we've helped thousands of financial institutions protect their critical software without drowning in technical details. Our solutions make regulatory requirements straightforward and manageable.

It's the final CPS 230 countdown

-

July 2023

APRA releases the final version of CPS 230, along with draft supporting guidance -

July 2025

CPS 230 officially comes into effect for all APRA-regulated entities -

October 2025

Submit a complete Material Service Provider (MSP) register to APRA -

July 2026

Deadline for non-SFIs to comply with CPS 230's business continuity and scenario analysis requirementsTransition period ends for pre-existing contractual arrangements with service providers

July 2023

APRA releases the final version of CPS 230, along with draft supporting guidance

July 2025

CPS 230 officially comes into effect for all APRA-regulated entities

October 2025

Submit a complete Material Service Provider (MSP) register to APRA

July 2026

Deadline for non-SFIs to comply with CPS 230's business continuity and scenario analysis requirements

Transition period ends for pre-existing contractual arrangements with service providers

Missing these deadlines puts everything at risk

Failing to comply with CPS 230 by the deadlines exposes your organization to:

Regulatory enforcement actions

APRA can issue formal directions or restrict business activities.

Additional capital requirements

You may be forced to hold increased capital until compliance issues are remediated.

Enhanced supervision

Expect intrusive oversight with increased reporting obligations and regulatory scrutiny.

Reputational damage

Non-compliance becomes public, which can undermine stakeholder and customer confidence.

Business continuity failure

Without proper protections, vendor disruptions could shut down your critical operations.

Don't wait until it's too late. Secure your software continuity compliance now.

E-BOOK

APRA's CPS 230: Your Complete Operational Resilience Guide

Fill in the form below to get expert advice on meeting APRA's operational risk management requirements.

*E-book available only in English

Get your free CPS 230 compliance guide

How you benefit from CPS 230 compliance

Avoid regulatory penalties

Meet APRA's requirements before the July 2025 deadline to prevent enforcement actions, increased capital requirements, and enhanced supervision costs that could impact your bottom line.

Protect critical operations

Ensure business continuity for essential financial services. CPS 230 compliance means your critical operations continue even when key software vendors experience disruption.

Build stakeholder trust

Demonstrate to customers, partners, and shareholders that your institution takes operational resilience seriously. CPS 230 compliance signals organizational maturity and risk awareness.

Strengthen board governance

Provide your board with clear evidence of regulatory adherence. CPS 230 compliance creates documented control over third-party risk that satisfies governance requirements.

Protect your critical operations before the deadline

Our compliance specialists will show you exactly how our escrow solutions meet CPS 230 requirements while safeguarding your operations from disruption.

Custom assessment of your specific compliance needs

Clear explanation of how escrow fulfills CPS 230

No technical jargon or complicated proposals

Actionable next steps you can implement immediately

Frequently asked questions

What is the CPS 230?

CPS 230 is APRA's new operational risk management standard starting July 2025. It sets minimum requirements for operational risk management, business continuity, and third-party oversight. Under CPS 230, financial institutions must identify critical functions, set acceptable disruption periods, implement preventive controls, and maintain continuity plans.

What is the difference between operational resilience and business continuity?

Operational resilience goes beyond traditional business continuity. While continuity focuses on recovery after disruptions, resilience aims to prevent disruptions and maintain operations within set tolerance levels. Business continuity is just one part of resilience, which also includes risk assessment, preventive measures, and governance oversight. For software systems, resilience means having verified access to source code and configurations, not just recovery plans.

Why is software escrow important for CPS 230?

Software escrow directly supports CPS 230 compliance by protecting critical software assets and enabling recovery if vendors fail. The standard requires financial institutions to manage operational risk and third-party dependencies. Software escrow creates a secure repository of source code and data that enables business continuity during vendor disruptions.

Can Codekeeper help with CPS 230 compliance?

Yes. Codekeeper provides specialized solutions that address CPS 230 requirements. Our platform secures critical software assets while verifying they work when needed. We handle the legal arrangements for access rights, automate the deposit process, and provide compliance documentation including Software Resilience Certificates. Our approach covers both operational resilience and third-party risk aspects of CPS 230, giving you one solution for software continuity compliance.

Is CPS 230 replacing CPS 220?

No. CPS 230 works alongside CPS 220, not in place of it. While CPS 220 established the broad risk management framework for APRA-regulated entities, CPS 230 focuses specifically on operational risk and resilience.

What is the difference between CPS 230 and DORA?

CPS 230 and Europe's Digital Operational Resilience Act (DORA) both target operational resilience in financial services but differ in scope and approach. CPS 230 applies to APRA-regulated entities in Australia with a principles-based methodology. DORA covers EU financial entities with more specific requirements for ICT risk management.