Insurance

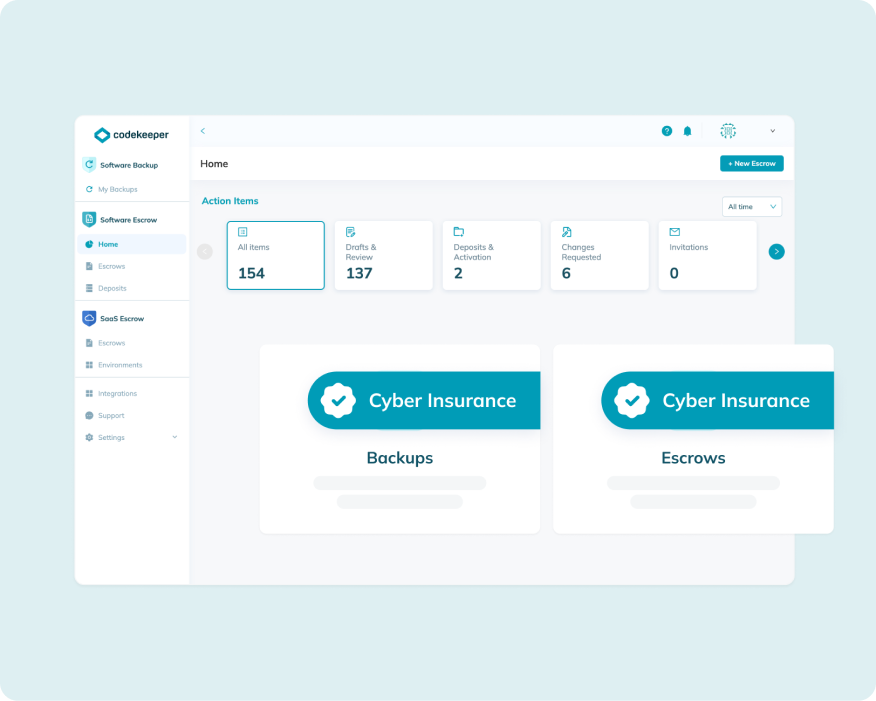

Cyber insurance that anticipates tomorrow’s risk

Protect your business today, tomorrow, and beyond with our proactive cyber insurance policies.

Our tech-driven world is a breeding ground for cyber threats. But your business doesn’t have to become collateral damage. We can shield your software assets and critical operations from the known unknowns.

Choose your cyber insurance shield

Get a protection plan that syncs with your business objectives. We offer various coverage levels to help you safeguard your digital assets, ensure operational resilience, and secure your future.

Disaster Recovery Coverage

Handle breaches with expert support

Pay for breach investigations, damage control, and system recovery.

Flexible limits starting at $25,000 per application

Includes disaster recovery services and hosting costs

Covers response measures in case of a security event

Protection against various liabilities, including errors and omissions

Get a quick free quote

Financial Loss Coverage

Guard against all cyber risks

Maintain your financial stability, even in the eye of a cyberstorm.

Adjustable coverage limits to suit your needs

Protection against income loss and associated costs

Discounted premiums for certified businesses (ISO, SOC2)

Coverage that scales with your revenue level

Get a quick free quote

Which protection level matches your needs?

Your cyber risk strategy should cover all the bases—including potential impacts on your bottom line. Let’s discuss how we can help shield you from every angle.

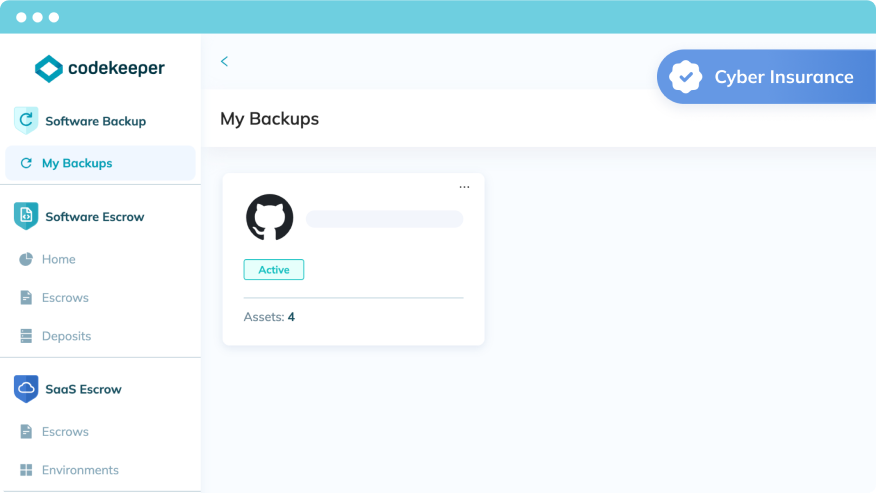

Why trust us to protect you from cyber threats?

We customize your insurance plan for your specific cyber threats.

We give you the tools and advice you need to prevent cyberattacks altogether.

Our team is always studying the latest threats to keep your protection up-to-date.

Some of the biggest businesses—like Nestlé and Deloitte—rely on us to keep them safe.

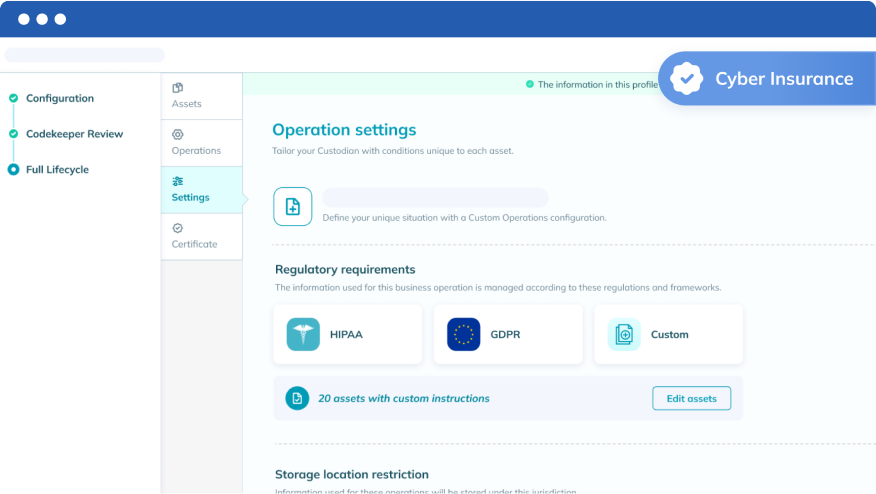

The right coverage for your industry-specific cyber threats

Here's how we can protect you against your sector's unique risks:

Software / SaaS companies

Fast data recovery to minimize downtime

Legal defense to solve your data law compliance issues

All-inclusive customer support

Regulated industries

Monetary assistance for regulatory penalties

Strong protection for private data

Rapid response and legal aid to mitigate damage

Government bodies

Quick restoration to reduce downtime

Fortification of communal assets and critical

Top incident response teams for effective threat

Infrastructure / societal impact

Reduced recovery costs and operation delays

Smart resource control to prevent surprise expenses

Better risk management to secure essential facilities

Words from those we protect

“Excellent service. This is easily the best way to handle it for both yourself and the client.”

“Codekeeper is a new service for creating escrow agreements for code, specifying the legal circumstances where source code can be accessed.”

“Source code escrow is a great service, and one that ALL developers who do client contract work should look into.”

Frequently asked questions

What does cyber insurance cover?

Cyber insurance protects your business from the costs of digital attacks. It covers legal fees for investigations and defense, data recovery and system restoration, business downtime losses, ransom payment demands, and regulatory fines and penalties.

Is cyber protection insurance mandatory?

Most laws don't require cyber insurance. But it's becoming essential for business survival. You might need coverage if you handle sensitive data, your clients require it, or your business partners demand it. While optional, cyber insurance protects you from growing digital threats that could harm your business.

Why do small businesses need cyber insurance?

Small businesses face growing cyber threats but often lack resources to respond. Cyber insurance provides financial security and business protection by covering costly data recovery, replacing lost business income, handling legal expenses, and paying regulatory penalties.

What is the most common cyber insurance claim?

The most common type of cyber insurance claim is for data breaches. A single breach can trigger major financial losses, brand damage, and regulatory fines.

Is it worth getting cyber insurance?

Yes, cyber insurance is worth considering. Cyberattacks target companies of all sizes, and recovery costs can devastate your business. Ransomware, data breaches, and system repairs demand resources that most companies don't have on hand. The right coverage helps you stay strong when attacks hit.

What is the difference between cybersecurity and cyber insurance?

Cybersecurity actively defends your systems through technical tools and staff training. It's your first line of defense against digital attacks. Cyber insurance, on the other hand, protects your finances when those defenses face stronger threats. It covers legal fees, data recovery, business losses, and regulatory fines after successful attacks.