DORA

Build resilient financial operations with software escrow

Protect your institution against third-party ICT risks and maintain operational continuity with comprehensive software escrow solutions designed for Europe's financial sector.

When your financial systems go down, money stops flowing. Your institution faces immediate operational chaos, customer exodus, and regulatory penalties that threaten your market position.

The DORA regulation explained

What is DORA?

The Digital Operational Resilience Act (DORA) introduces a complete framework for managing technology risks in the EU financial sector. It sets strict standards for financial institutions and their critical ICT service providers to strengthen these entities’ resilience against operational disruptions—and to keep the EU’s financial system stable in our volatile but very connected digital world.

Who needs to comply with DORA?

If you’re part of the EU financial sector, DORA likely applies to you. This includes:

Banks and credit institutions

Investment firms

Insurance companies

Financial market infrastructures

Payment and electronic money institutions

ICT third-party service providers

Crypto-asset service providers

6 key DORA requirements

DORA requires the following from financial institutions to strengthen their digital resilience and meet regulatory standards:

ICT risk management

Implement frameworks to identify, assess, and mitigate risks.

Incident reporting

Establish protocols for swift reporting of major ICT incidents.

Resilience testing

Conduct regular vulnerability assessments and penetration tests.

Third-party risk management

Monitor and manage ICT provider risks.

Information sharing

Exchange cyber threat intelligence to boost collective resilience.

Operational continuity

Develop thorough plans on how to operate during and recover from disruptions.

How Codekeeper supports your DORA compliance efforts

The pressure to fortify digital operations is intense. Consider the stakes: Your critical software vendor suddenly goes bankrupt. Or a cyberattack compromises your cloud applications. These are the kinds of risks DORA is pushing you to prepare for. It’s a tall order—especially when you’re already juggling day-to-day operations. Here’s how Codekeeper can help:

ICT risk management

Our escrow services act like a safety deposit box for your critical code and data.

We’ll work with you to create and test disaster recovery plans so you’re prepared for the unexpected.

.png)

Resilience testing

We’ll help you regularly stress-test your IT infrastructure to spot vulnerabilities before they become problems.

Third-party risk management

Our SaaS Escrow protects your cloud applications if vendors fail.

Our Software Escrow safeguards traditionally licensed software.

Operational continuity

We provide quick system restoration after disruptions.

Our Continuity Escrow keeps cloud apps running despite vendor issues.

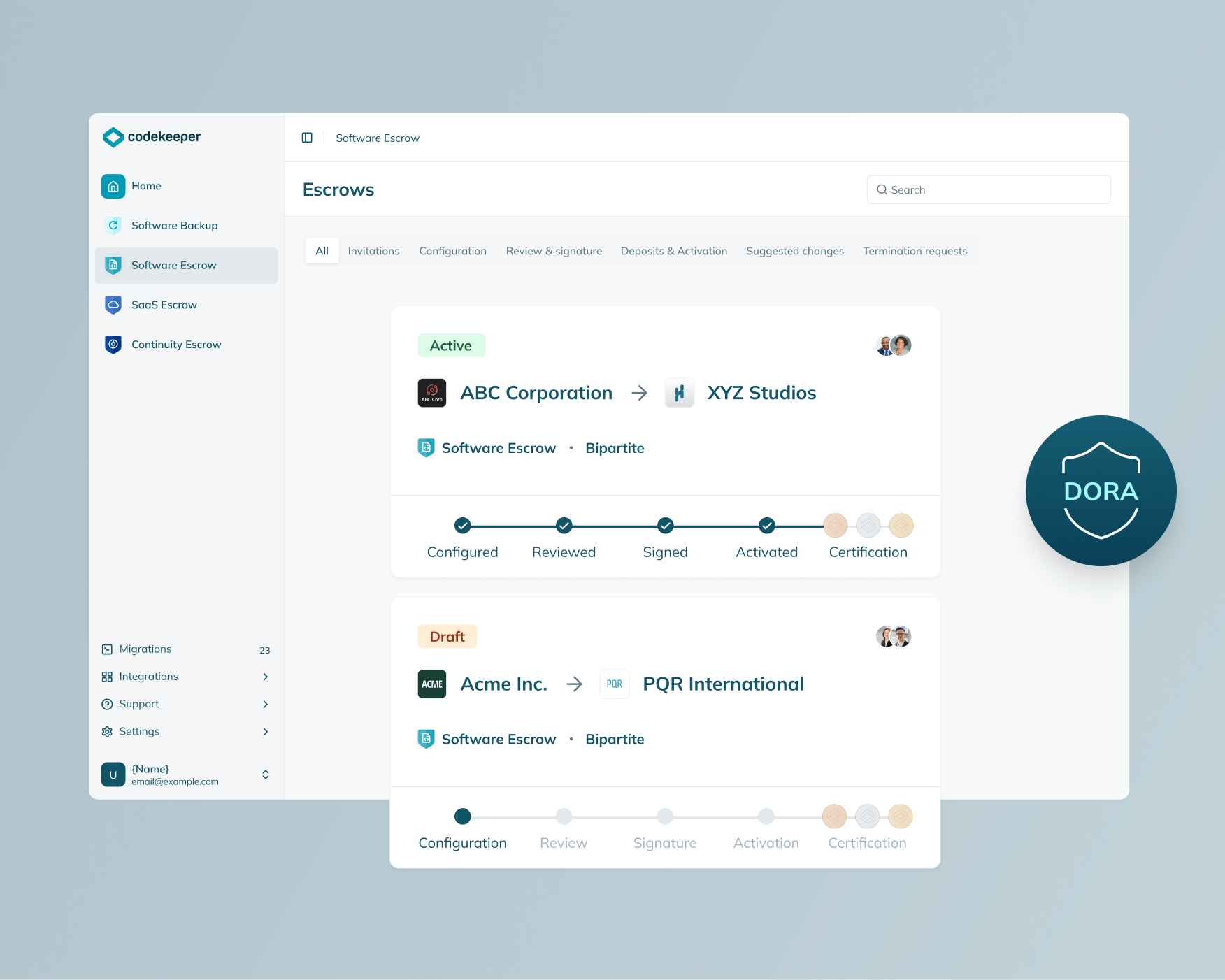

Secure DORA software resilience in 4 steps

DORA requires you to maintain access to critical software if vendors fail. Here's how to fulfill this requirement quickly:

1. Book your software dependency review

We'll identify which banking and trading applications need source code protection to meet DORA's third-party risk requirements.

2. Invite your team to set up secure code deposits

Your vendors place their source code, documentation, and build instructions into our protected escrow vaults.

3. We verify your assets are complete and usable

Our experts test that the escrowed materials can rebuild your software for real operational continuity.

4. Get your Software Resilience Certificate

Receive proof that regulators want to see — documented evidence you can maintain critical systems at all times.

We provide concierge support at every step.

Book a free demo

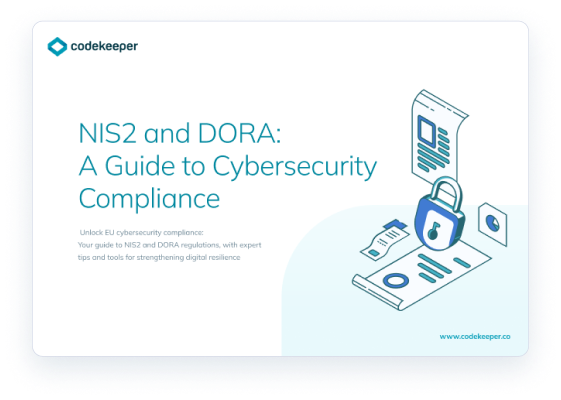

E-BOOK

Prepare for DORA by 2025: Get your guide

Our comprehensive resource simplifies DORA compliance. It can help you avoid penalties and strengthen your cybersecurity. Download the guide now to prepare for 2025 and beyond.

*E-book available only in English

Get your free NIS2/DORA guide now!

NIS2 vs. DORA: Key differences and how they affect you

This infographic breaks down the key differences and similarities between NIS2 and DORA. You can use it to identify your regulatory obligations and plan your compliance strategy.

|

|

NIS2

Network Information Security

|

DORA

Digital Operational Resilience

|

|---|---|---|

|

Key differences

|

|

|

|

Key differences

|

||

|

Scope

|

Broad, covering multiple critical sectors

|

Focused on the financial sector

|

|

Scope

|

||

|

Broad, covering multiple critical sectors

|

Focused on the financial sector

|

|

|

Impacted sectors

|

Energy, transport, healthcare, etc.

|

Banks, insurers, investment firms, etc.

|

|

Impacted sectors

|

||

|

Energy, transport, healthcare, etc.

|

Banks, insurers, investment firms, etc.

|

|

|

Primary focus

|

Overall cybersecurity resilience

|

Digital operational resilience in finance

|

|

Primary focus

|

||

|

Overall cybersecurity resilience

|

Digital operational resilience in finance

|

|

|

Similarities

|

|

|

|

Similarities

|

||

|

Objective

|

Enhance EU-wide cybersecurity

|

|

|

Objective

|

||

|

Enhance EU-wide cybersecurity

|

||

|

Risk management

|

Require robust frameworks

|

|

|

Risk management

|

||

|

Require robust frameworks

|

||

|

Incident reporting

|

Mandatory for significant events

|

|

|

Incident reporting

|

||

|

Mandatory for significant events

|

||

|

Third-party oversight

|

Emphasis on supply chain security

|

|

|

Third-party oversight

|

||

|

Emphasis on supply chain security

|

||

Both regulations aim to strengthen Europe's digital defenses. Understand your obligations and act now.

Codekeeper's customized compliance solutions for your business

We understand that compliance isn’t one-size-fits-all. That’s why we offer:

Needs assessments: We evaluate your IT infrastructure, risk profile, and vendor networks to identify compliance gaps.

Scalable software resilience: Our solutions adapt to your specific recovery and/or continuity objectives.

Customized escrow agreements: We tailor escrow agreements to address supply chain security and vendor oversight requirements.

Ongoing support: Our team is available 24/7 and can guide you as regulations evolve.

Frequently asked questions

Why is DORA necessary?

DORA is necessary to address the increased risk of cyberattacks in the financial sector. It aims to ensure that the financial industry can maintain operational resilience despite ICT disruptions and threats.

What are the five pillars of the DORA regulation?

The five pillars of DORA include ICT risk management, incident reporting, resilience testing, third-party risk management, and information sharing.

How does DORA differ from GDPR?

DORA focuses on the financial sector's digital resilience, while GDPR protects the privacy and security of personal data held by organizations.

Who is excluded from DORA?

DORA typically doesn’t apply to non-financial entities and small/micro enterprises—unless they're critical to the financial stability of the European Union.

What are the penalties for non-compliance with DORA?

Non-compliance with DORA can result in fines of up to 1% of the ICT service provider's average daily worldwide turnover, depending on the severity and duration of the infringement.